Options for Dummies

Learn how to trade options

Welcome

Option Basics Menu

Option Cheat Sheet

Profit Table

| Option Style | Opening Transaction | Profit When |

|---|---|---|

| Call | Buy |

price increases

|

| Call | Sell |

price decreases

|

| Put | Buy |

price decreases

|

| Put | Sell |

price increases

|

Important Definitions

- Call option - Contract that gives the buyer the right to buy stock from the seller at the low strike price and sell the same stock to the market for the higher market price.

- Put option - Contract that gives the buyer the right to buy the stock from the market at the lower market price and then sell the same stock to the seller at the high strike price.

- Strike Price - The price where the underlying stock would have to be (or better) in order to exercise the option.

- Option Expiration - Stated as the month and year in which the option contract expires. It is typically the close of trading on the third Friday of the month.

- In the money - Term used to describe an option where the market price of the underlying stock is above (for Call Option) or below (for Put Option) the strike price.

- Intrinsic value - That portion of the option premium that correlates to how much it is "in the money".

- Time value - That portion of the option premium that is not Intrinsic Value. The farther away the current date is from the expiration date, the more Time Value you have.

- Net Debit - Type of transaction where you end up paying money to either open or close a position.

- Net Credit - Type of transaction where you receive money to open or close a position.

Option Naming Scheme

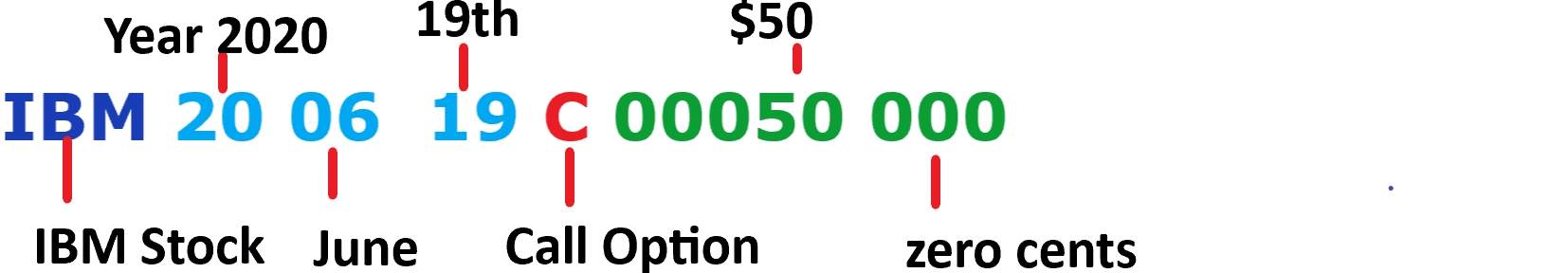

The option naming standards are surprisingly easy to understand. Lets break it down with an example:IBM200619C00050000

Okay lots symbols. But it follows this pattern:

[symbol][Year][Month][Day][Call or Put][strike price]

| Pattern | Description |

|---|---|

| Symbol | The stock symbole. Up to 6 characters if required. Normally 3 to 4. |

| Year | 2 digit format for year. E.g., 20 for 2020. |

| Month | 2 digit format for month. E.g., 01 for January. |

| Day | 2 digit format for the day within the month. |

| Call or Put | C for Call. P for put |

| Strike Price | 8 digits for the strike price. Imagine there is a decimal after the 5th digit. In our example above, '00050000' would be $50. Another example: IBM210115C00110000 would be for strike price $110. |

So in our above above example for IBM200619C00050000, it's shown in our graphic below.